Solar System Price in Pakistan 2025 Expert Breakdown

Solar System Price in Pakistan 2025 – Expert Breakdown With Real Calculations

Pakistan’s energy landscape is undergoing a seismic shift in 2025, driven by skyrocketing electricity tariffs, chronic load-shedding, and a flood of affordable Chinese solar imports. With NEPRA’s base tariff hovering at Rs. 34 per unit for FY 2025-26—down slightly from Rs. 35.50 but still punishing in higher slabs up to Rs. 55/kWh—households and businesses are ditching the grid for solar at an unprecedented pace. Last year, Pakistan imported 17 GW of solar panels, double the previous year’s volume, propelling the country to the world’s third-largest panel importer. By mid-2025, rooftop solar could supply 20% of total electricity demand, outpacing grid growth in urban hubs like Lahore and Karachi. For Solwave Energy, a leader in premium installations, this boom underscores solar’s role as both a financial shield and a sustainable lifeline.

But amid the hype, questions linger: What’s the real solar system price in Pakistan 2025? How do you calculate true ROI with net metering tweaks? This expert breakdown draws on NEPRA data, import trends, and on-ground installations to deliver precise costs, calculations, and strategies. Whether you’re eyeing a 5kW setup for a small home or a 20kW hybrid for a factory, we’ll unpack components, savings, pitfalls, and fixes—empowering you to invest wisely.

The Solar Surge: Why Pakistan’s Market is Exploding in 2025

Pakistan’s solar revolution isn’t fueled by subsidies alone; it’s a market-driven response to grid failures. Electricity demand grew just 3-4% in 2024, lagging historical norms as consumers fled high bills—average household costs hit Rs. 25-35/kWh after fuel adjustments. Enter solar: Global panel prices plummeted 50% due to Chinese overcapacity, dropping to Rs. 27-36 per watt locally. Coupled with duty-free imports (extended to mid-2025) and net metering, installations soared—cumulative imports from 2019-2025 exceed 2 GW, rivaling the nation’s entire grid capacity.

In rural areas, solar tube wells are transforming agriculture: Half of diesel pumps could switch by 2030, adding 5.6-7.5 GW of distributed PV and slashing fuel imports. Urban adopters, facing 8-12 hour blackouts, prioritize hybrids with batteries. NEPRA projects solar generation doubling to 4,447 GWh in 2025, claiming 1.6% of the energy mix. Yet, policy whiplash looms: The buyback rate under net metering slashed from Rs. 27/kWh to Rs. 10/kWh for new users in July 2025, extending paybacks but still yielding 20-30% annual ROI.

For businesses, the math is compelling: A Lahore textile mill saved Rs. 1.2 million annually on a 50kW system, offsetting 40% of operational energy costs. Solwave Energy’s clients report similar wins, but success hinges on system sizing and quality—overhyped cheap imports often underperform in Pakistan’s dusty, high-heat conditions.

Demystifying Solar Systems: On-Grid, Off-Grid, or Hybrid?

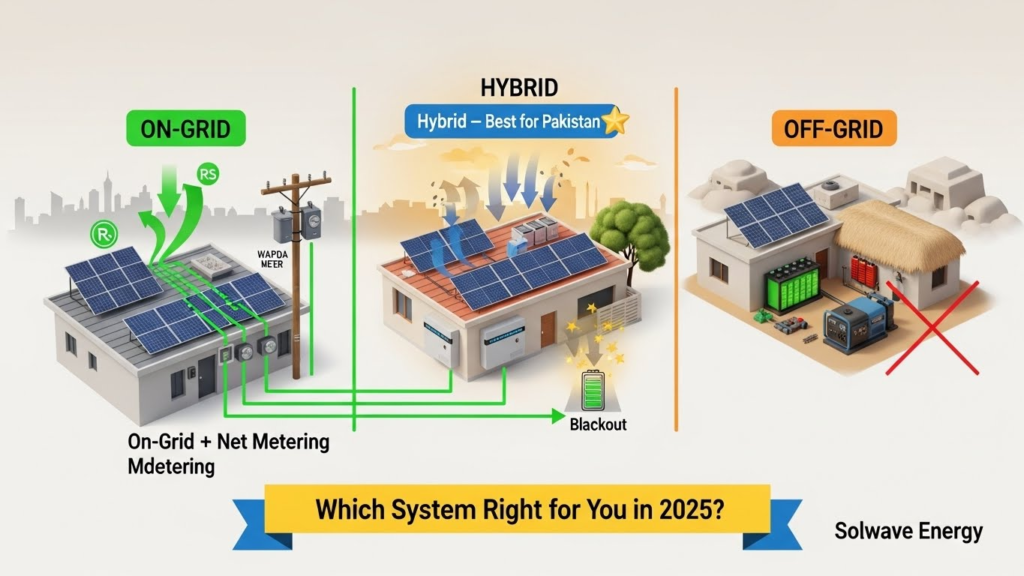

Before diving into prices, grasp the basics. Solar systems convert sunlight to DC power via photovoltaic (PV) panels, then AC via inverters for home use. Key types suit Pakistan’s variable grid Solar System Price in Pakistan 2025 Expert Breakdown:

- On-Grid (Net Metered): Ties to the utility for excess export. Ideal for sunny cities; no batteries needed, cutting costs 30-40%. Drawback: Blackouts kill power unless paired with a changeover switch.

- Off-Grid: Standalone with batteries for remote areas like Balochistan farms. Powers essentials during nights but demands deep-cycle lithium batteries (Rs. 200,000-500,000 extra).

- Hybrid: Best for urban reliability—combines grid-tie with battery backup. Solwave’s hybrids auto-switch during loadshedding, ensuring 24/7 uptime.

Components break down as: Panels (60-70% cost), inverter (15-20%), batteries (10-20% for hybrids), wiring/mounting (5-10%). Efficiency matters—monocrystalline panels (18-22% efficient) outperform polycrystalline (15-18%) in Pakistan’s 5-6 peak sun hours daily.

What Drives Solar System Prices in Pakistan 2025?

Prices aren’t static; they fluctuate with imports, rupee volatility (USD/PKR at 280), and component tiers. Recent drops—5kW systems fell Rs. 150,000 in December 2025—stem from 17 GW imports flooding the market. Key influencers:

- Panel Quality: Tier-1 brands like LONGi or Jinko (Rs. 30-35/watt) last 25 years with 80% output; no-name imports (Rs. 24/watt) degrade faster in 40°C heat.

- Inverter Brand: GoodWe/Solis (Rs. 100,000-200,000 for 5-10kW) offer 5-10 year warranties; Chinese generics fail prematurely.

- System Size & Type: Larger setups scale efficiently (Rs. 90,000-110,000/kW for 10kW+ vs. Rs. 110,000-150,000/kW for 3kW).

- Installation & Location: Rooftop mounts add Rs. 20,000-50,000; Karachi’s humidity demands corrosion-resistant frames (+10% cost).

- Incentives: Zero sales tax on panels until mid-2025; Punjab/Sindh subsidies (up to Rs. 50,000 for low-income) via free panels. Post-July net metering cut, hybrids gain traction for self-consumption.

Expect 10-15% inflation on batteries due to lithium shortages, but overall systems remain 20% cheaper than 2024.

2025 Price Breakdown: From 3kW Starter to 20kW Commercial

Based on December 2025 market rates from ProPakistani, Alpha Solar, and Feroze Power, here’s a granular breakdown. Prices include panels, inverter, mounting, and basic installation (excluding batteries unless noted). All figures in PKR; hybrid adds 20-30% for 5-10kWh lithium storage.

| System Size | On-Grid Price | Hybrid Price (w/ Batteries) | Daily Output (kWh, Lahore Avg.) | Appliances Powered |

|---|---|---|---|---|

| 3kW | 350,000 – 450,000 | 500,000 – 600,000 | 15-18 | Lights, fans, fridge, 1 AC |

| 5kW | 550,000 – 780,000 | 750,000 – 950,000 | 25-30 | + Washing machine, 2nd AC |

| 7kW | 625,000 – 850,000 | 850,000 – 1,100,000 | 35-42 | Full home + small office |

| 10kW | 900,000 – 1,200,000 | 1,200,000 – 1,500,000 | 50-60 | Home + EV charger |

| 15kW | 1,300,000 – 1,700,000 | 1,700,000 – 2,100,000 | 75-90 | Small factory |

| 20kW | 1,575,000 – 2,000,000 | 2,000,000 – 2,500,000 | 100-120 | Medium business |

Solar System Price in Pakistan 2025 Expert Breakdown Sources: ProPakistani (Dec 2025 drop), Alpha Solar (on-grid specifics), Feroze Power (10kW range).

Component split for a mid-range 5kW on-grid: Panels (12x 415W, Rs. 360,000), Inverter (5kW GoodWe, Rs. 120,000), Structure/Wiring (Rs. 50,000), Installation (Rs. 20,000). Total: Rs. 550,000. For hybrids, add Rs. 200,000 for 5kWh Pylontech batteries—essential for 4-6 hour backups.

Real example: A Faisalabad homeowner installed a 7kW hybrid via Solwave for Rs. 950,000 in October 2025. It powers two 1.5-ton ACs, fridge, and lights, generating 1,200 units monthly—vs. grid’s Rs. 40,000 bill.

Crunching the Numbers: ROI and Payback with 2025 Realities

ROI isn’t hype; it’s math. Formula: Annual Savings / Initial Cost x 100 = ROI %. Payback = Cost / Annual Savings. Assume Lahore’s 5.5 sun hours/day, Rs. 35/kWh tariff (post-FCA), and Rs. 10/kWh net metering export.

5kW On-Grid Home System

Cost: Rs. 600,000 (mid-range).

Monthly Generation: 750 units (25 kWh/day x 30).

Self-Use: 600 units (saves Rs. 21,000 at Rs. 35/unit).

Export: 150 units (earns Rs. 1,500 at Rs. 10/unit).

Total Monthly Savings: Rs. 22,500. Annual: Rs. 270,000.

Payback: 600,000 / 270,000 = 2.22 years.

ROI: (270,000 / 600,000) x 100 = 45%.

Over 25 years: Rs. 6.75 million savings, minus Rs. 100,000 maintenance—net gain Rs. 6.65 million.

10kW Hybrid for Small Business

Cost: Rs. 1,300,000 (incl. 10kWh batteries).

Monthly Generation: 1,500 units.

Self-Use: 1,200 units (saves Rs. 42,000).

Backup Value: Batteries offset Rs. 5,000 in diesel genset fuel.

Export: 300 units (Rs. 3,000).

Total Monthly: Rs. 50,000. Annual: Rs. 600,000.

Payback: 1,300,000 / 600,000 = 2.17 years.

ROI: 46%. Post-payback, free power for 23 years yields Rs. 13.8 million.

Adjust for Karachi (4.5 sun hours): Add 20% to payback. Batteries degrade 1-2%/year, but Solwave’s warranty covers 80% capacity at year 10. Pre-July net metering users lock in Rs. 27/kWh exports, slashing payback to 1.5 years—grandfathered installs remain golden.

Unlocking Benefits: Beyond Bill Cuts

Solar slashes costs 70-90% while boosting resilience. A 2025 WRI study shows adopters cut emissions by 1-2 tons CO2/year per kW, aiding Pakistan’s 30% renewables target by 2030. Health wins: No diesel fumes mean fewer respiratory issues in polluted cities. For farmers, solar irrigation drops water costs 50%, per IEEFA data. Solwave clients in Sialkot report 25% productivity gains from uninterrupted power.

Tackling Hurdles: Problems and Proven Fixes

Challenges persist: Dust cuts output 20-30% without quarterly cleaning (Rs. 5,000/service). Solution: Solwave’s anti-soiling coatings and remote monitoring apps. Grid integration delays? NEPRA approvals now take 2-4 weeks; pre-apply via our portal. Battery fires from fakes? Stick to UL-certified lithium—our audits ensure compliance. Financing gaps? SBP’s green loans at 8-10% interest cover 70% upfront, repayable via savings.

Policy risks like the net metering slash? Diversify with hybrids for 90% self-sufficiency. Inverter failures in monsoons? IP65-rated units from Solwave withstand 100% humidity.

Partner with Solwave: Your 2025 Solar Edge

As Pakistan’s trusted installer with 5,000+ projects, Solwave Energy blends Tier-1 components, 10-year warranties, and NEPRA-compliant designs. Our free audits size systems to your bill—contact us for a custom quote.

Final Verdict: Solar’s 2025 Payoff is Now

In 2025, solar system prices in Pakistan deliver unmatched value: 2-3 year paybacks, 40%+ ROI, and energy independence. Don’t wait for tariff hikes—calculate your fit today. With Solwave, transition seamlessly to clean, cheap power.